Cook Protocol establishes a transparent and flexible asset management platform suited to diverse investors and asset management service providers alike.

Investors can monitor the manager’s fund allocations without worrying about fund security and foul-play.

On the other hand, fund managers can leverage Cook Protocol to get access to investors and carry out virtually any investment strategy without open-sourcing their strategy.

ABOUT COOK PROTOCOL

Cook Protocol is built on Ethereum blockchain that establishes a generic asset management platform, providing investors with a selection of asset management vehicles from fund managers.

Funds can be managed passively or actively through whitelisted DeFi protocols.

For each investment fund, a unique ERC-20 token proportional to their contribution to the fund, is issued to investors.

Investors can divest the tokens anytime in exchange for the equivalent underlying asset. An investor invests crypto assets accepted by a particular fund in exchange for ERC20 tokens representing partial ownership of the fund. This ERC-20 token, or ckToken, is unique to each fund and can be exchanged among investors or redeemed for its underlying assets inside the fund.

The concept of a ckToken is similar to a share in the stock market, especially with financial products such as Exchange Traded Funds (ETFs).

Thus, a ckToken equates to a percentage of ownership in an investment fund, with its value being proportional to the investment fund’s value.

For each investment fund, its ERC-20 tokens become fungible assets that can then be traded among investors, providing convenience and reducing transaction fees.

A fund manager initializes a fund by defining an overall strategy and fee structure, accepting assets and access limits to each of the whitelisted DeFi protocols.

Cook Protocol allows fund managers to describe investment strategies to attract suitable investors. Funds are then pooled from investors into a smart contract so that the fund manager can allocate passively, following a specific index, or actively, managing multiple financial product streams.

For each investment fund, the fund manager is granted with the proper permissions according to the smart contract, which allows the manager to allocate funds to the whitelisted DeFi protocols, such as Compound, 0x, and Synthetix.

The amount of funds allocated to each DeFi protocol cannot exceed a pre-determined limit and can only be revised through fund-level governance.

In return for providing asset management services, the fund manager is compensated through a fee-based model, where investors take all gains and losses while paying a fixed fee to the fund manager.

While each transaction within the fund market is transparent, the actual investment strategy can remain opaque to the outside world to spur innovation.

By default, fund managers will pay 2% when they claim the management fees.

Fund managers do not need to pay platform fees if they decide to withdraw their management fees in COOK tokens.

100% of the platform fees are then redistributed to COOK token holders who actively contribute to our ecosystem.

The platform fees are subject to change by the community governance in the future.

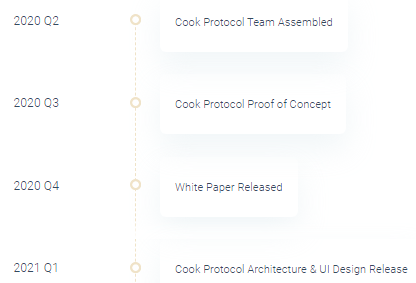

ROADMAP

FOR MORE INFORMATION:

AUTHOR:

sir ocik

https://bitcointalk.org/index.php?action=profile;u=2427580

ETH: 0x8523A3E2d30600d7dE9616770A3D607AFff42A30

No comments:

Post a Comment